Special: What goes up must come down.

In a companion piece to John Scalzo's

The Stock Market Game, we bring you an edition with a PC-centric mindset. Despite the fact that gamers, publishers and developers have been claiming that the PC market will be dead shortly it has continued to flourish in recent years with exclusive titles like

Crysis,

Neverwinter Nights 2 and of course

World of Warcraft. The three aforementioned games were all created by companies that John already covered, but their are some key players in the PC gaming sector that deserve their spot in the sun as well, namely the hardware manufacturers that are so crucial to PC gaming. As the market continues to plunge in the new year the chance to buy low, sell high is looking like a strong possibility. Today we will analyze AMD, Intel, Nvidia, Western Digital and Micro Technologies, a few of the key players in the gaming hardware sector see how 2007 treated them, what to expect from them in 2008 and if an investment may be worth the risk.

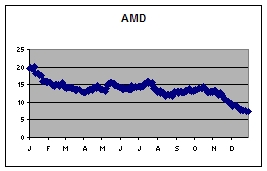

AMD

AMD

For those unaware AMD bought Nvidia's main competition in the high-end graphics card sector in July 2006. Since then the semiconductor maker, and main rival to Intel has struggled to show investors that the acquisition was a solid investment. Due to one-time fees associated with the $5.4 billion deal the once profitable company has struggled to return to the black. On top of that recent reports have shown that AMD has lost market share in both its key areas, semiconductors and graphics cards. The company dropped from 23.06% in 2006 down to 22.26% for 2007. The loss includes a drop in the graphics card market as well, with bitter rival Nvidia and Intel's discrete graphic chips stealing chunks of ATi's desktop market share.

Because of all this, and the worrisome economy in general, AMD's stock price dipped to a 52-week low of $5.31 per share just days after the new year. But the information is not all bad for AMD. First off the ATi division did manage to win some market share on the mobile side of things, which is the fastest growing market now. On top of that most analyst and industry insiders are frothing at the mouth for their new Radeon HD 3870 X2 which is expected to take the market lead in performance away from Nvidia for the first time in two years. Hector Ruiz, CEO of AMD, also stated in a recent earnings call that he expects the company to return to the black as early as Q2 2008, but that later in the year is more likely.

Outlook: Although the company is currently in the dumps, with one of the lowest stock prices it has ever seen, the time is ripe to pick up a bundle of AMD on the cheap.

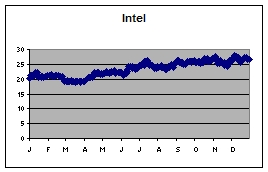

Intel

Intel

Intel has rebounded from its lackluster Pentium 4 days to return as the powerhouse of the semi-conductor industry. As mentioned above the company gained the marketshare it had lost to its main rival AMD, as well as from other smaller competitors such as VIA. From 2006 to 2007 the company gained 2.34% of the processor market, raising the company's dominance back to 77.46%. It is still a far cry from its market dominance of the 90's where it held over 85% of the market but the company has expanded in different directions since then. Intel now also maintains a commanding force in the integrated graphics market, so much so that the company maintains the highest install-base for all graphics accelerator even after factoring in add-in cards from AMD and Nvidia. The company also continues to spread into the super-mobile sector with the just announced "Atom" series of processors designed for ultra-low power laptops and mobile devices. Differentiating itself even further, it was announced last week that Intel had purchased

Project Offset creators Offset Software, designers of the impressive Offset Engine. This is the second company (the first being the creators of the popular physics middleware, Havok Physics, in September 2007) Intel has purchased directly associated with the video game sector in under a year.

The company's stock price for 2007 shows just how well the semi-conducting giant has fair in comparison to its main competitor. While AMD's stock has plummeted for the year, Intel has seen its shares climb some 31% in the same timeframe. As mentioned above the company has recently bought a pair of middleware company's involved in the massively profitable gaming sector. Most notable of those acquisitions is the Irish company Havok, whose engine runs on almost every popular platform currently available including PlayStation 2, PlayStation 3, PlayStation Portable, Xbox, Xbox 360, Wii, GameCube, Windows, Apple OSX, and even Linux. To top it off, the technology will basically run on anything with a functional C++ compiler, the main programming language used to create video games. As for its "core" market, Intel is again the dominate force with their Core2 line continuing to outperform the AMD K10 chips, while at the same time they are managing to design the Nehalem, a processor based on an entirely new and highly ambitious architecture.

Outlook: Since the PC processor market has slowed down the company was forward looking enough to diversify itself, allowing it to remain profitable despite changing their core market drastically from single to dual and quad core processors. A solid and safe investment by most counts with a small average dividend to boot.

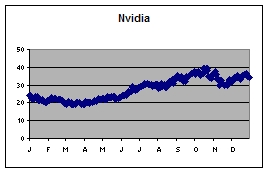

Nvidia

Nvidia

Like Intel to AMD, Nvidia reclaimed their performance edge from ATi in 2007 with their release of the ridiculously powerful GeForce 8 series of cards. The company posted a solid year as far as bragging rights are concerned, garnering the top spot in the desktop market for graphics devices. According to reports the company had managed to obtain over 37% of the market while Valve's Steam survey showed that gamers preferred Nvidia products over 62% of the time, crushing ATi's ~31%. The company has also seen the sales of their specially designed RSX GPU increase as they PlayStation 3 (the sole user of the technology) has continued to sell, even if it has been slower than expected. AMD/ATi did manage to hold off Nvidia in one key area though. Nvidia failed once again to make headway into the laptop market, grabbing the third spot with just over 22% of the market, a market which is the fastest-growing computer market.

Nvidia's shares have performed much better in the market than their main rivals although that doesn't mean much. While AMD saw their shares plummet, Nvidia saw theirs hit a high of over $50 per share before settling back at $34.02 for a loss of $2.06 a share on the year. The company's stock dropped after the third quarter after rises in production costs associated with the GeForce 8800 GT bit into their profit margins. Looking forward, the ATI vs. Nvidia battle is likely to resume as AMD's Radeon HD 3870 X2s are poised to take over the performance crown from the GeForce 8 line-up. Nvidia has said that their GeForce 9 line-up while be available shortly after the new Radeon's but early reports don't look promising. One advantage that Nvidia has given itself is the adoption of the PhysX system into its graphics cards, which became available after Nvidia purchased AGEIA in early February.

Outlook: The company's newly acquired PhysX technology being integrated into the graphics card line-up should help the GeForce 9 stay interesting as long as it can be integrated at low costs and without delays. Nvidia is also expanding itself into the wide open cell phone market with special made GPUs that continue to amaze us, a move that should certainly pay off. Looks like this one is a pretty solid bet, although strong gains like we saw for the first three quarters in 2007 aren't expected.

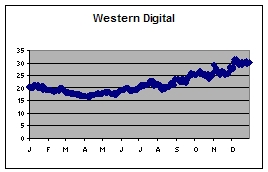

Western Digital

Western Digital

Although the idea of maxing out your gaming rig with redundant 10,000RPM drives may have seemed like an insane idea back when Western Digital released the technology in 2003, the innovation the company brings to the harddrive market will always be insane. The company was the first to release 250GB drives for the laptop sector in 2007, and trumped themselves later that year as the first to release 320GB HDD. The storage sector is full of competent competitors including the largest harddrive manufacturer in the world, Seagate and smaller less specialized companies such as Hitachi, Toshiba and Samsung to name a few, but none of them hold as many innovations helpful to gamers or as successful a track record as WD. Along with the industry's largest laptop HDD, WD also managed to bag a third place spot finish the the race for 750GB desktop drives, then trumped that with second place finish to Hitachi for the world's first 1TB drive. The company then went on to upgrade their highly successful MyBook external drive line with a single 1TB drive.

So with such a healthy 2007 product line how could their stock not be in the black? It should come as no surprise that the harddisk drive specialists stock has performed admirably over the course of 2007, gaining an impressive 48% during the turbulent 2007 economy. So the past looks solid, but what about the present and the future. For starters, the company's stock continues to rise, sitting at $31 a share as of press time. Recent downgrades from select analysts have many investors worried as they should be. Although the company will probably have another solid year, the emerging and competing technology of Solid-State Drives is a real threat to HDD specialists such as Seagate and Western Digital.

Outlook: WD's MyBook line should remain a smashing success throughout the year but as SSD prices continue to fall the new technology could begin to eat into Western Digital's desktop and laptop businesses. Lucky for them, SDD will most likely remain too pricey for at least another year.

Micron Technologies

Micron Technologies

The loser in the PC gaming market is without a doubt Micron Technology, parent company of the Crucial brand of RAM. Unlike Atari, Micron is in no need of major saving as they remain the last bastion of DRAM technologies for the United States as their local competitors have either been bought up or close shop. Micron's main competition these days comes from overseas adversaries such as Infineon, Samsung, and Hynix. But unfortunately for Micron Technology their main sector, DRAM technologies, has not been booming, nor have they created any breakout technology or products recently. Instead the company rode out 2007 on their core offerings such as the computer enthusiast Ballistix line, while beginning to diversify themselves with research into the aforementioned Solid-State Drives and even technologies for use in smart cars.

As mentioned, Micron as a company did not manage any break-out product this year, or even manage to get anyone excited about future technologies. A mid-year transition of President of Micron from long-standing President, Steve Appleton to COO Mark Durcan probably didn't help the company either. Over the course of 2007 Micron's shares fell more than 48%, closing the year at $7.25 and still declining. The company is in a bad way at the moment but if they can trim operating costs and continue a solid showing in the DRAM sector while capitalizing on the infantile Solid-State market they could turn 2008 into a profitable year.

Outlook: This year should be an uphill battle for the United States' last DRAM producer. Prices are low but the tech sector is always touchy and the company doesn't seem to have any new mass market offerings in the works.

Full disclosure: Patrick owns shares of AMD and Intel.